Credit Management Training Course

WHEN A BUSINESS FAILS it’s almost always due to cash flow problems that arise from late-paying customers, or debtors, and unpaid invoices. But as the number of small businesses in Australia have increased in the last five years, so too have the number of closures resulting from inefficient cash flow.

WHEN A BUSINESS FAILS it’s almost always due to cash flow problems that arise from late-paying customers, or debtors, and unpaid invoices. But as the number of small businesses in Australia have increased in the last five years, so too have the number of closures resulting from inefficient cash flow.

An inquiry by the Australian Small Business and Family Enterprise Ombudsman (ASBFEO) into payment times and practices in Australia has revealed that poor cash flow is the primary reason for insolvency in Australia.

Not every business suffering cash flow problems goes insolvent right away. Many more, especially those operated by sole traders, struggle on with clients and customers who don’t pay on time or, worse, not at all.

Indeed, a recent study commissioned by PayPal and QuickBooks Intuit, found that Australian small businesses are owed a collective $26 million in unpaid invoices. That’s roughly $13,200 owed to each business at any given time, for which business owners will spend an average of 12 days chasing each year.

Perhaps 12 days out of 365 doesn’t seem like much time spent chasing invoices, but look at it this way: The ACCC estimates that nearly three-quarters of all business invoices are paid late, while recent figures released in Dun & Bradstreet’s quarterly Trade Payments Analysis report found that businesses wait an average of 44.9 days for payment, with businesses in the ACT, NSW and WA waiting the longest: between 46 and 50.4 days.

Credit and Debt Management: From New Clients to Regular Clients

It doesn’t matter which way you paint it. Credit and debt management is one of the most overlooked aspects of operating a small business and it’s affecting the business owners who can least afford it.

Figures released by the Australian Bureau of Statistics (ABS) found that closure rates for businesses were higher among those with an annual turnover of under $50,000 than those with an annual turnover of more than $2 million.

For a small business to thrive and prosper, it must implement efficient measures to manage its debtors. Our complete guide to Credit and Debt Management Processes and Systems for Small Business will show you how to do just that, regardless of the size or type of business you operate. Our Credit and Debt Management Training Guide helps you understand how good credit and debt management principles can be applied at every stage of dealing with new clients from credit assessment, quoting and deposits, monthly management and enforcement.

NOTE: This training program is available for members of EzyLearn’s Bookkeeping Academy

Topics in this Credit Controller Training Course program

Assessment & Risk Management

These are the steps that a business can take before they agree to provide goods and services to a new or existing client. These credit risk procedures help ensure that customers pay your business according to your terms.

- Deposit Payments

- Credit Applications

- Terms of Trade

- Reservation of Title

- Liability and Warranty

- Credit Risk for Tradies

Daily and Monthly Credit Risk Management

Set your business up with the correct credit risk management procedures to ensure that you manage the daily and weekly tasks to ensure that customers pay when the money is owing.

- Quoting and Invoicing

- Payment / Credit Terms

- Accounts Receivable Reports

- Delinquency

- Late payments and Follow up

- Security

Debt Collection and Enforcement

If you’ve set up your credit risk management procedures correctly you can enforce payment correctly and ensure you get paid. If you are not paid you can get a better outcome if your customer goes into administration or receivership.

- Debt recovery process

- Value of risky debt over time

- Bad debts

- Security and Liens

- Enforcing a payment

- Litigation and Court

Online Bookkeeping Certificate Training Courses

Credit Management procedures are designed and implemented at various stages of the accounting process but most occur on a regular basis. Daily, Weekly and Monthly reports are run to ensure that high credit risk events or situations are avoided.

Learn about common bookkeeping training courses

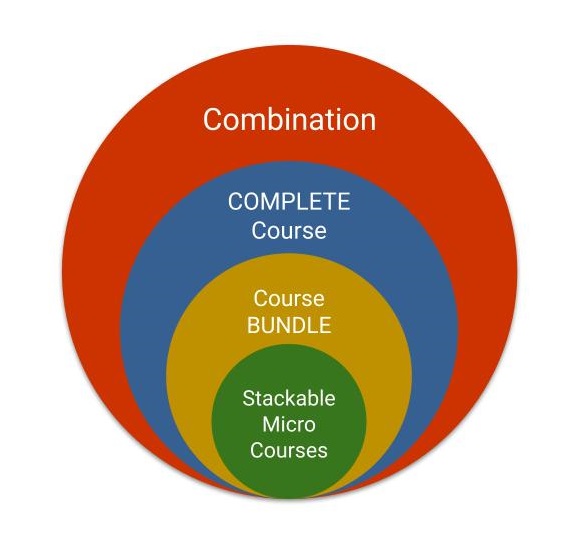

Included in some online accounting courses

If this area of accounting studies or work interests you please make contact with a course consultant to learn more about courses or course combinations which include this training program.

Find out which courses include the Credit Controller Training Program

Here’s a Quick Intro to the Cash Conversion Cycle

Training Inquiry

Get the right training for your needs

MYOB Courses Xero Courses QuickBooks Courses Excel Courses

EzyLearn Pty Ltd Online Bookkeeping, Microsoft Office and Digital Marketing Training Courses

- Do You Need a Bookkeeper or an Accountant? Or Someone Else?by Steve Slisar on 2024-04-20 at 3:25 am

There are many finance professionals — who does your business need? WE’VE MENTIONED PREVIOUSLY THAT finding a bookkeeper, when you may not know much about bookkeeping, can be a difficult task. In fact, a lot of new business owners assume their accountant will take care of everything for them, which may be costly if their accountant has The post Do You Need a Bookkeeper or an Accountant? Or Someone Else? appeared first on EzyLearn Pty Ltd.

- How to get employers contacting youby Steve Slisar on 2024-04-17 at 3:01 am

Employers like small business owners are looking for staff online using Google. From office admin and business administration tasks to bookkeeping and customer service and sales, employers need staff to keep their businesses running. The only way you are going to get discovered is if you have an online profile that CAN GET DISCOVERED and The post How to get employers contacting you appeared first on EzyLearn Pty Ltd.

- Is this what you look like when you cram for studies? School Holiday CRAM Saleby Steve Slisar on 2024-04-12 at 10:54 pm

Most complete courses are now discounted. If you want to learn something new now is the time to take advantage of discounted course fees and still have 12 months to complete your course. See the discounted courses here. Do you like the featured image for this blog post? It was free and created by Canva’s The post Is this what you look like when you cram for studies? School Holiday CRAM Sale appeared first on EzyLearn Pty Ltd.

- Who do you trust less? Microsoft, Mailchimp, Google or Apple?by Steve Slisar on 2024-04-10 at 11:25 am

The features that each of these companies provide is invaluable for businesses. We can’t do without most of them in some way and when they started you, like me, probably turned on all the features and opted into their “labs” to test out new features. Then things changed. These companies are now mature and they The post Who do you trust less? Microsoft, Mailchimp, Google or Apple? appeared first on EzyLearn Pty Ltd.

- MYOB is better than Xero Payroll for some thingsby Steve Slisar on 2024-04-03 at 12:52 am

All the marketing messages I hear is how much better Xero is than MYOB but that isn’t always the case. MYOB and QuickBooks both had more in-build inventory features than Xero but Xero has always promoted their integrations to fill gaps in their core software. I wrote about this several times: The Integrations for Xero The post MYOB is better than Xero Payroll for some things appeared first on EzyLearn Pty Ltd.

We work remotely from home and we’d like to help you.

We work remotely from home and we’d like to help you.